Click here to listen to this article

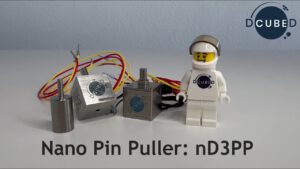

Small Businesses Mean More Launches

Over the last five years, the NewSpace industry has had significant transformation; marked by an increase in the number and diversity of launch opportunities. The emergence and growing influence of small businesses in this sector has been transformative, advancing the industry by providing innovative solutions, specialized components and services and in many cases, driving costs down and allowing access to technologies that would have previously been unavailable to smaller enterprises, universities and research institutions. As of Q2 2021, there were over 10,000 businesses in the space sector, with almost 5,600 of them in the US alone. Spending for NASA in 2021 showed that while most people think NASA contracts only with large entities, 90% of NASA’s contracts were with small businesses representing more than $3.5 billion in the US alone. These small businesses have emerged as central players, heralding an era where Space Release Nuts, Space Pin Pullers, Space Release Actuators, Deployable Solar Arrays and more are not just components, but trusted innovation and efficiency. These small businesses have filled gaps left by larger corporations by advancing the industry forward with shape memory material products and other sophisticated materials as a different trend started to emerge in 2019-2021.

Whereas previously large, slow government contracts were won by large prime contractors like Airbus, Boeing or Lockheed, a shift to a more commercial approach was underway. Not every nut and bolt was required to be custom built, but instead commercial, off the shelf (COTS) parts started being sourced, assembled and launched. Instead of a few, very expensive, bespoke satellites; thousands of inexpensive satellites started being built using COTS parts.

More importantly, with small businesses focusing on niche aspects within the broader space ecosystem, not only have costs reduced, parts become more available and affordable, but efficiency has increased and development cycles for space missions have shortened. 1 2

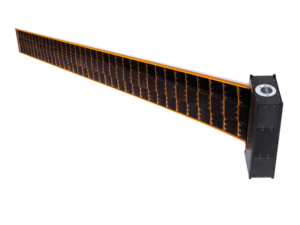

With all these realized time, efficiency and design savings, in recent years the surge in launch activities underscores the rapid growth of the sector, with the number of satellites being deployed shattering records annually thanks to advancements in space deployables, larger space deployable solar arrays to provide more power for more complex instruments and mechanical devices.

Launch Trends and Global Economic Impact

If you want to get an idea of how large the dramatic upturn of launches has been in the last few years, 2021 saw 146 orbital launches – the highest number since 1967 with 139 launches. 2022 shattered records again with 186 successful launches. 1 6 2023 saw the record shattered again with 212 successful launches, up 23%. 4 5 The first quarter of 2024 has seen 66 successful launches and already looks to surpass 2023’s record, underlying the rapid growth of the NewSpace sector. 3

Small business growth helping collaborative partners achieve things faster, easier and less expensively allows for more missions to be completed, turning the bottleneck for number of annual launches towards the number of rockets available to carry missions. But when we say that the commercialization of space and small business contributing to greater results has impacted the global space economy, what do we really mean?

NewSpace Economy Value By Year

· 2020: The global space economy was valued at approximately $447 billion, representing a 55% increase compared to a decade prior – highlighting a consistent upward trend. Commercial space activities, which constituted nearly 80% of the total space economy at that time, grew 6.6% to nearly $357 billion. Despite a slight decrease in global government space spending by 1.2%, the overall space economy continued to show robust growth. 7

· 2021: The space economy climbed to a value of $469 billion, marking a 9% increase from the previous year. This increase was recorded as the highest growth since 2014, demonstrating continued expansion and interest in the space sector amid global challenges. 8

· 2022: The value of the global space economy reached a new high of $546 billion, which was an 8% increase from 2021. This continued growth underscored nearly a decade of upward trends, further demonstrating the expanding commercial and governmental interests in space technologies and enterprises – while showcasing greater gains from small businesses. 10

· 2023 and Beyond: The sector showed no signs of cooling down as the global economy hit $630 billion, an almost 9% increase annually. While some analysts predicted cooling due to flat governmental spending and slowing consolidation amongst commercial entities, 2024 has already been the fastest to space with 41 launches before the end of March. Predictions are that the global space economy, driven by innovation, will surpass $1.6 trillion by 2030. 11

Broader Horizons, Bigger Demands Moving Forward

The NewSpace industry is only going to get bigger as companies now look to extend past Low Earth Orbit (LEO Altitude 500-1,200km) and into Medium Earth Orbit (MEO, 5,000-20,000km) and Geostationary Earth Orbit (GEO, 36,000km). Whereas there are over 6,768 satellites currently in LEO, there are just 159 in MEO (generally used for internet and GPS services) and only 580 in GEO, according to the UCS Satellite Database. This shift carries huge implications for power systems and will lead to a cascade of opportunities for small businesses in space. 9

As companies eye MEO and GEO 12, more sophisticated and powerful onboard systems will be required. Longer mission lifespans and operations will have to be considered, more power will be required to transmit signals farther back to Earth (or to the Moon), all requiring new innovations in power storage and capabilities. New, innovative solutions like In Space Manufacturing (ISM) and flexible blanket solar arrays that minimize stowage, yet can be built and unfurled in space to maximize power generation will be necessary to provide the increased power MEO and GEO satellites will require. Stronger optical systems to beam information faster will be required, as will larger antennas, optical systems and ways to disperse the increased amounts of heat generated by onboard devices through deployable radiators and other similar devices.

Part of the shift of why MEO and GEO are being eyed for new missions is the change in satellite sizes over the last decade. Initially, satellites were the size of school buses (over 1000+kg). A decade ago, a standard called CubeSats, which changed not only how space engineering was being taught to the next generation of dreamers, but also allowed access to the building of satellites to many more people because of it’s small size and mass (1-100kg).13 While small CubeSats are still widely built by universities and research organizations, commercial entities have started building larger satellites again. Initially CubeSats were used by commercial enterprises for mission and tech demos – and the results and development cycles were stunning.

Now, those companies that previously built a business case around their CubeSat efforts are attempting to maximize their return on investment. This means they are willing to accept a bit more mass, more volume and a slightly higher cost; but the performance is vastly improved, resulting in greater returned data and/or signal resolution when launching a large CubeSat (i.e. 16U) or a MicroSat.

As NewSpace transitions into MEO and GEO, it provides a pivotal moment for the industry to continue maturing, advancements in almost every portion of mission design, but also lay the groundwork for the next frontier of space innovation and exploration. The NewSpace industry has matured the how and when of utilizing small businesses to build more efficiencies and savings, now the scope of those efficiencies must expand as the sector eyes further distances, and eventually planets.

Sources:

www2.deloitte.com · #1

Future of the space economy | Deloitte Insights

Get the Deloitte Insights app. This growth in the global space sector is creating opportunities for new players and new offerings for incumbent ones. 2022 was a record year for the space sector, with 186 successful rocket launches (41 more than in 2021)—the most ever, 2 signaling a rapid transformation of the space sector.

atlanticcouncil.org · #2

The NewSpace market: Capital, control, and commercialization

However, Asia has experienced the most significant growth in this market over the last five years and now holds 25 percent of the market share. 17 “Space Economy Report 2022. … The key challenges to NewSpace industry growth are the regulatory landscape and access to financing. This is evidenced by the European NewSpace ecosystem where, at a …

spacefoundation.org · #3

The Space Report 2023 Q4 Shows Record Number of Launches for Third Year …

14 new launch vehicles set to launch in 2024 COLORADO SPRINGS, Colo. — Jan. 23, 2024 — Space Foundation , a nonprofit organization founded in 1983, offering information, education and collaboration for the global space ecosystem, today released The Space Report 2023 Q4, which shows the busiest year ever for space.

newspaceeconomy.ca · #4

Report: Space Activities in 2023 (Jonathan McDowell 2024) | New Space …

In 2023, there were 221 orbital launch attempts globally, of which 209 were successful, 11 failed, and 1 was a partial failure. A total of 207 payloads were catalogued from the launches. The 221 launch attempts in 2023 set a new annual record, up 20% from 2022. The number of orbital payloads launched also hit an all-time high of 2,891 …

spacestatsonline.com · #5

Orbital launches in 2023 | Space Stats

Last update: 2024-03-31 « Orbital launches by year • Previous year • Next year Orbital launches in 2023 Launches by month: Launches by launch sites * for airborne launches the take off site of the carrier aircraft is considered. Countries:

seradata.com · #6

2021 Launch Year: A new record for both orbital rocket and … – Seradata

The final score for orbital launches in 2021 was 146 – a record number since space launch history began with the launch of

spacefoundation.org · #7

Global Space Economy Rose to $447B in 2020 … – Space Foundation

This $447 billion space economy is 55% higher than a decade ago and part of a five-year trend of uninterrupted growth. Commercial space activity grew 6.6% to nearly $357 billion in 2020, still representing close to 80% of the total space economy. Global government space spending fell 1.2% in 2020 to $90.2 billion from a revised 2019 peak of $91 …

mckinsey.com · #8

How will the space economy change the world? | McKinsey

Governments, often working with companies in the private sector, can use satellite images and data to gain valuable intelligence, such as information on the movement of troops or the installation of weapons systems. According to the not-for-profit Space Foundation, the space economy was valued at $469 billion in 2021, up 9 percent from 2020 …

nasa.gov · #9

Space Manufacturing Technology Report – NASA

Manufacturing & The Space Economy: Today, space systems development takes too long and costs too much, and the high cost of operating in the space industry limits new entrants and competition. Manufacturing technology advancements will play a critical role in maintaining U.S. industry leadership in a hypercompetitive global environment.

thespacereport.org · #10

Space Economy News and Articles – The Space Report

The global space economy reached a new high of $546 billion in 2022, an increase of 8% from a revised 2021 figure of $506

The World Economic Forum #11

https://www.weforum.org › press › 2024/04 › space-ec… Space Economy Set to Triple to $1.8 Trillion by 2035, New …

Apr 8, 2024 — The global space economy will be worth $1.8 trillion by 2035, up from $630 billion in 2023 – almost twice the rate of global GDP growth …

Is MEO Poised for New Growth As Satellite Market Shifts? #12

Kratos Defense & Security Solutions https://www.kratosdefense.com › constellations › articles

… LEO and could see increased use in the future as satellite companies look to diversify uses for MEO satellites in innovative ways.

viasat.com #13

https://news.viasat.com › blog › scn › how-big-is-that-s… How big is that satellite? A primer on satellite categories

Apr 27, 2021 — Satellites come in many shapes and sizes for a variety of missions. … Mini satellites (100-500 kg) have really, well, taken off in recent years.